Axis Bank is one of the largest and most trusted banks for NRI services in India. The bank provides various options under NRI Fixed Deposit. In this article we will enlist various fixed deposit options available for an NRI along with the latest latest Axis Bank NRE FD Rates (up to 7.10%*) and other Axis Bank NRI Fixed Deposit Interest Rates.

Note: All the interest rates mentioned above are subject to change without prior notice. We update the latest interest rates on NRE FD and Savings Bank Account as well as the interest rates for FCNR Deposit every month with the banks on our blog. You can head there to check out the latest rates.

NRIs can choose from 7 different types of NRI FD Schemes available for them at Axis Bank. They are:

Note: This account provides a Forward option, where an existing FD account can be booked for a forward date. Under this deposit, at the specified time, funds in the linked FD are transferred to Pro FCNR Deposit.At this time, conversion from INR to foreign currency is done on a locked-in exchange rate. This way, one can hedge exchange rate fluctuations at the time of conversion.

| Schemes | Tenure | Taxation | Premature Withdrawal | Loan Against FD |

|---|---|---|---|---|

| Non Resident External Rupee Deposit | 1-10 years | Tax-Free | Available; with penalty | Overdraft facility for up to 85% of deposit |

| NRO Rupee Deposit | 7 days-10 years | 30% TDS + surcharge and cess | Available for deposits below Rs. 5 crore; penalty levied | Available upto 85% of the deposit |

| FCNR Deposit | 1-5 years | Tax-Free | Available (T&C apply) | Available in INR or foreign currency; (T&C apply) |

| NRI Pro Foreign Currency Deposit | 3 months-5 years | Tax-Free | – | – |

| NRI Pro Rupee Deposit | 3-5 years | Tax-Free | – | – |

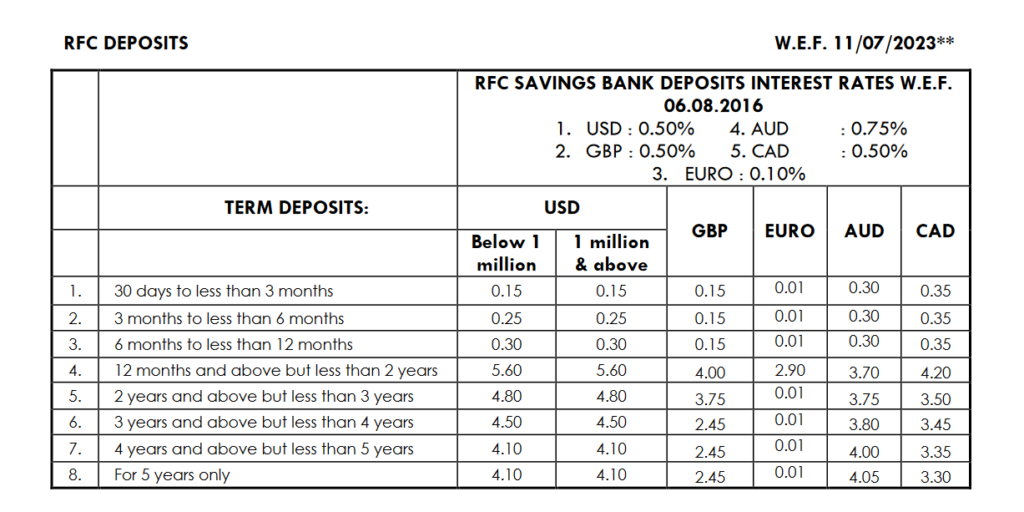

| RFC Term Deposit | 30 days-5 years | Taxable in India | Available | – |

| NRI Fixed Deposit Plus | Flexible | NRE (Tax-Free); NRO (30% TDS plus surcharge and cess) | Not Available | – |

Click on the button below to understand NRI FD with our FD expert

Get Expert Advisory and Assistance with Axis Bank NRI Fixed Deposits| Schemes | Premature Withdrawal |

|---|---|

| NRE FD | – No penalty for deposit below Rs. 5 crore in NRE FD – 1% penalty charged for deposits above Rs. 5 crores in NRE FD – No interest payable if NRE FD closed prematurely before completion of 1 year |

| NRO FD | – Premature Closure Penalty Rate shall be charged on deposits below Rs. 5 crore which would be lower of: 1) 1% less the card rate at the time of withdrawal 2) 1% minus the base rate at the time of booking 3) NRO FD rate for the period for which deposit was with the bank – Premature withdrawal of deposits above Rs. 5 crores shall be charged at 1% minus the contracted base rate or 1% minus the prevailing base rate, whichever is lower – No interest payable on deposits withdrawn before 7 days from the date of booking |

| FCNR Deposit | – No penalty charged for individual deposits below USD 1 million/ Euro 1 million/ GBP 750,000/ JPY 125 million/ AUD 1.5 million/ CAD 1.5 million – Deposits above the said limits mentioned above shall be charged with 1% penalty minus: 1) The contracted card rate 2) Card rate at the time of withdrawal, or 3) Card rate for the tenure for which deposit remained with the bank – No interest payable if the fund is withdrawn before completion of 1 year |

| RFC FD | – No penalty charged for individual deposits below USD 1 million/ Euro 1 million/ GBP 750,000/ JPY 125 JPY/ AUD 1.5 million/ CAD 1.5 million |

Axis bank provides loans against NRI fixed deposits to finance a situation for up to 85% of the deposit amount. However, this limit may vary for some of the schemes. Loans can be taken for personal/ business purposes.

Note: Loans can’t be taken for carrying out agro-based activities or real estate business activities or for re-lending.

You can book your NRI FD instantly by submitting the following documents to Axis Bank:

To get end to end assistance with NRI Account Opening and booking Fixed Deposits, you can connect with our expert using the button at the end of the article. You can also browse through the NRI Account Opening grid that we have prepared specially for NRIs and get expert advisory and assistance seamlessly and complete the entire process at the comfort of your homes.

Calculate your returns on FD and much more with an expert. At SBNRI, you get direct access to field experts who will take care of your process personally and assist you throughout the way. Just click on the button below to get in touch with our expert now. Also, visit our blog and Youtube Channel for more details.

NRI deposits by Axis Bank can be opened by Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) other than those residing in Pakistan and Bangladesh.

What is the highest Axis Bank NRE FD rate?Highest Axis Bank NRE FD rate is 5.50% for tenure ranging from 5 years to 10 years.

What is the maximum deposit amount for Axis Bank NRE FD?There is no maximum limit set for bulk NRE deposits. Customers can deposit for more than Rs. 100 crore.

Is it mandatory to provide a PAN card for NRI FD in Axis Bank?Yes. The applicant has to provide a PAN card or Form 60 for the application to be processed.

Is loan against FD available for NRE Rupee FD?Yes. Loan can be applied against NRE Rupee FD, however purpose must be provided which should not include relending, agro-based activities and real estate business.